FOLLOW THESE STEPS FOR

QUICK AND

EASY ENROLLMENT

FREQUENTLY ASKED QUESTIONS:

GENERAL QUESTIONS

Our AGRIBANK Mobile App is supported on the following platforms:

-

iOS and iPadOS (iOS/iPadOS 13 and above)

-

Android (version 8 and above)

Yes! All critical information is encrypted, and no personal information is stored on your mobile device. However, mobile devices do offer you the ability to store your login information for apps installed on the device. If you choose to store your login information, any person who has access to your mobile device can access your account.

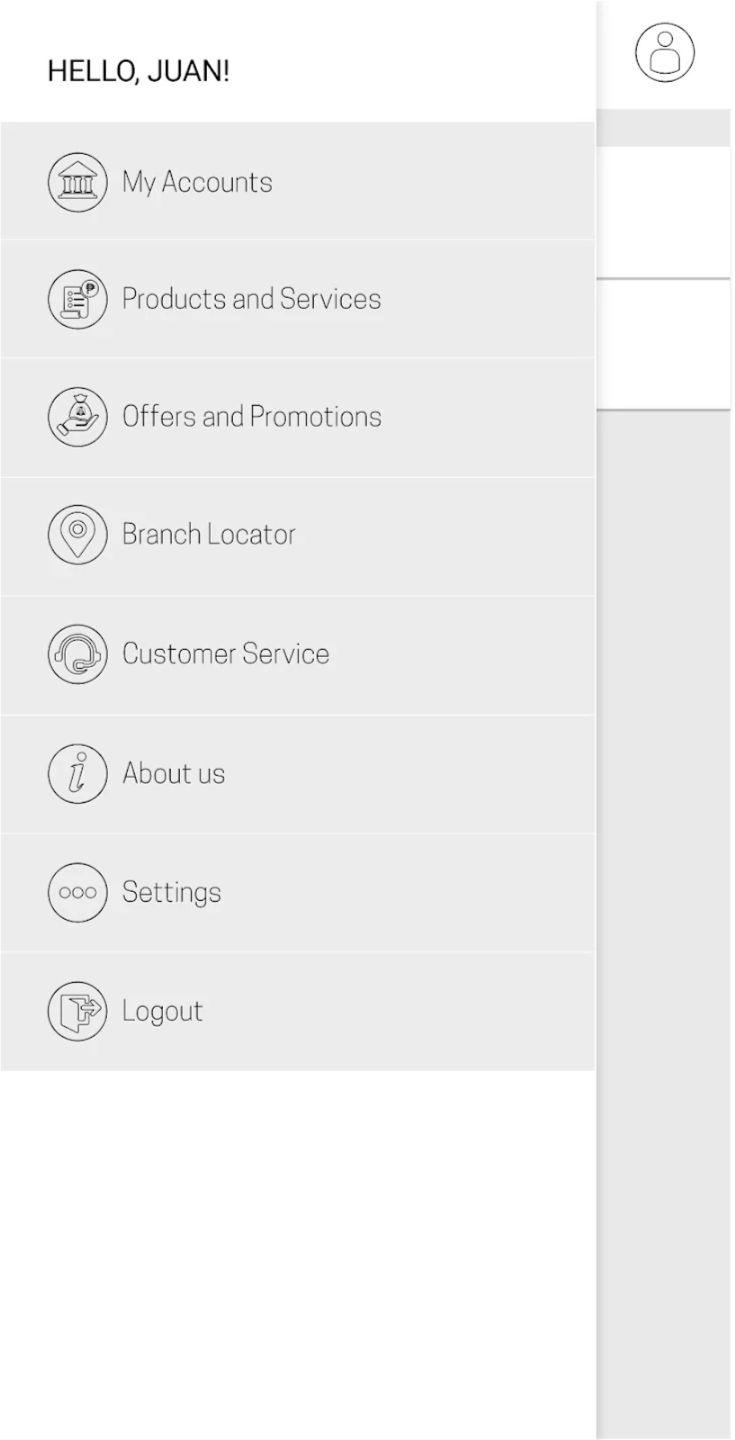

The mobile app gives you the ability to you to access your account information, view offers, view Agribank products and services, report an issue, and contact us via email or phone. Once you’ve installed the mobile App on your phone, you’ll also have the ability to view a map of our branches/branchlites.

AGRIBANK provides a high level of security, the person will not be able to log in using your PIN or biometrics. However, as always, it is your responsibility to take all reasonable precautions to prevent the fraudulent use of your security information.

If your mobile device is lost or stolen, or you feel your log-on credentials may have been compromised, call us as soon as you can to let us know. We recommend that you contact your service provider to have your device deactivated.

Your mobile banking session will time out automatically after a period of inactivity. Unlike online banking, there won’t be a pop-up message advising that it will time out.

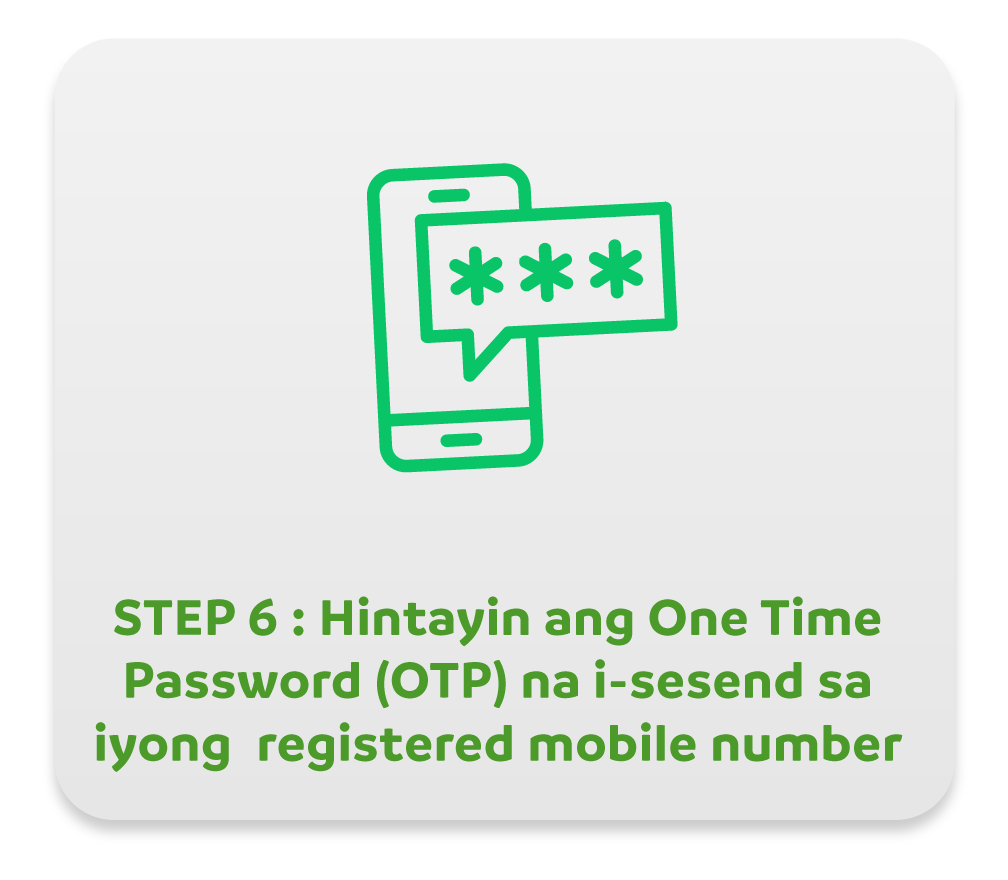

You’ll need to reset it by generating a new OTP to set up your new security features.

IN-APP QUESTIONS

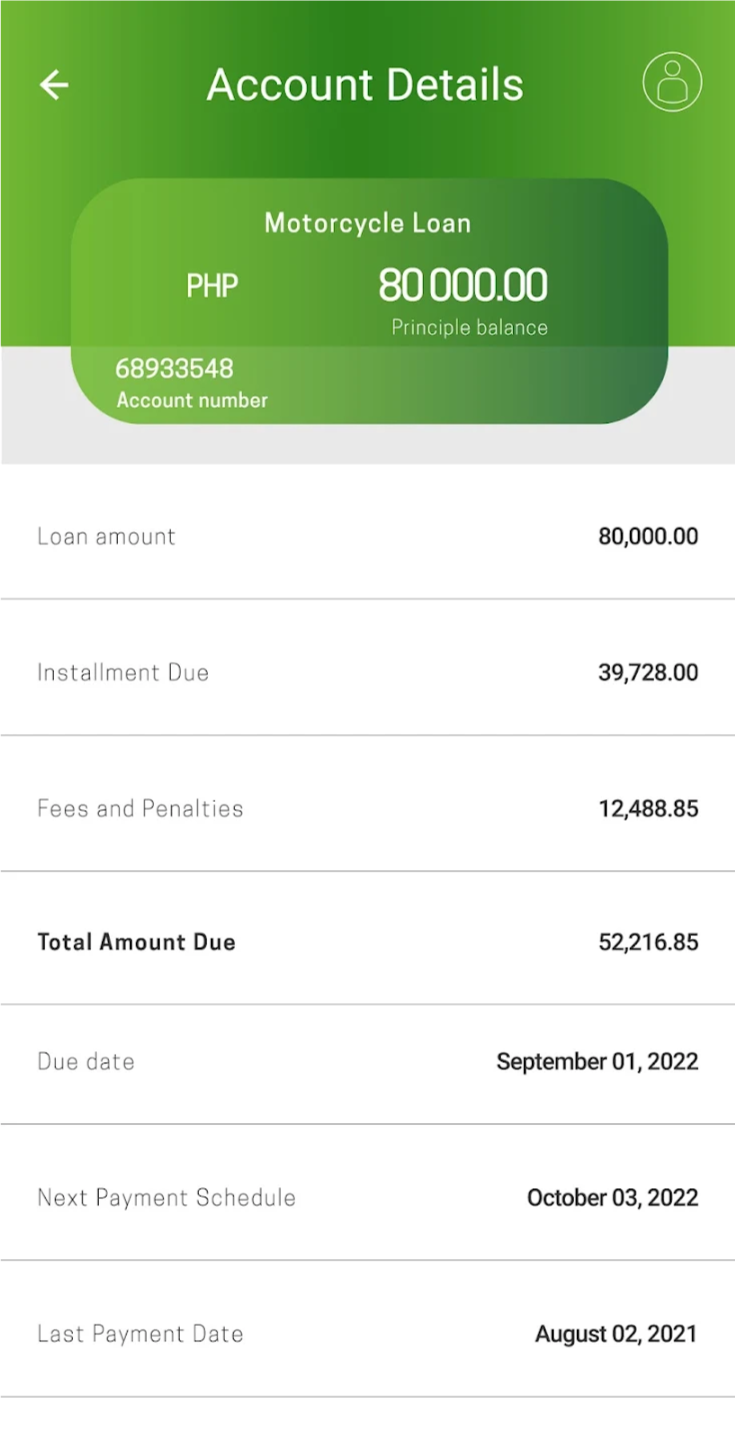

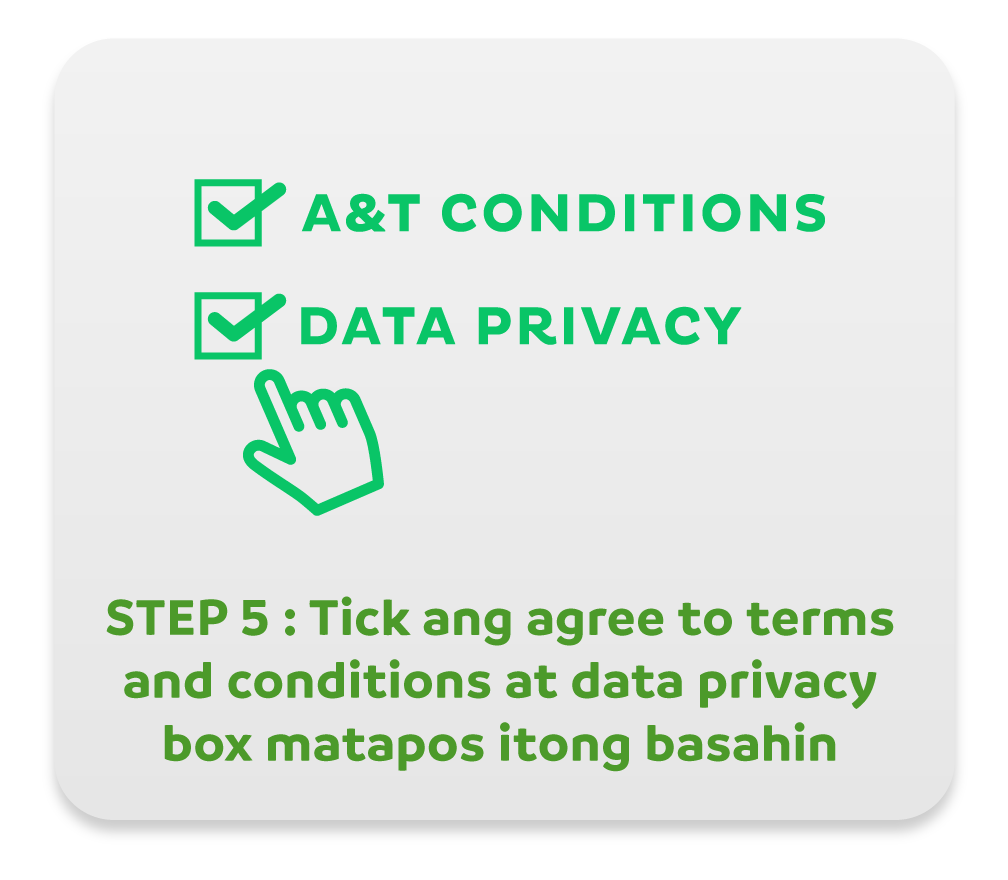

To set up your account details on the app, you’ll need to make sure your phone/mobile number is updated. You need your AGRIBANK log-on details for the account enrollment (Full name, birthday, mobile number, type of account, account ID, email) to enroll your account on the mobile app.

It’s either you do not have the same number as you have in the system, or there is another account that uses the same number as you.

Please contact your branch about this issue to update your information immediately.

It is possible that an error upon your application occurred, causing a piece of your information enrolled in the system is different than your original information. Follow the details provided on your receipt from the bank.

If you wish to change your information, contact your branch about this issue to update your information immediately.

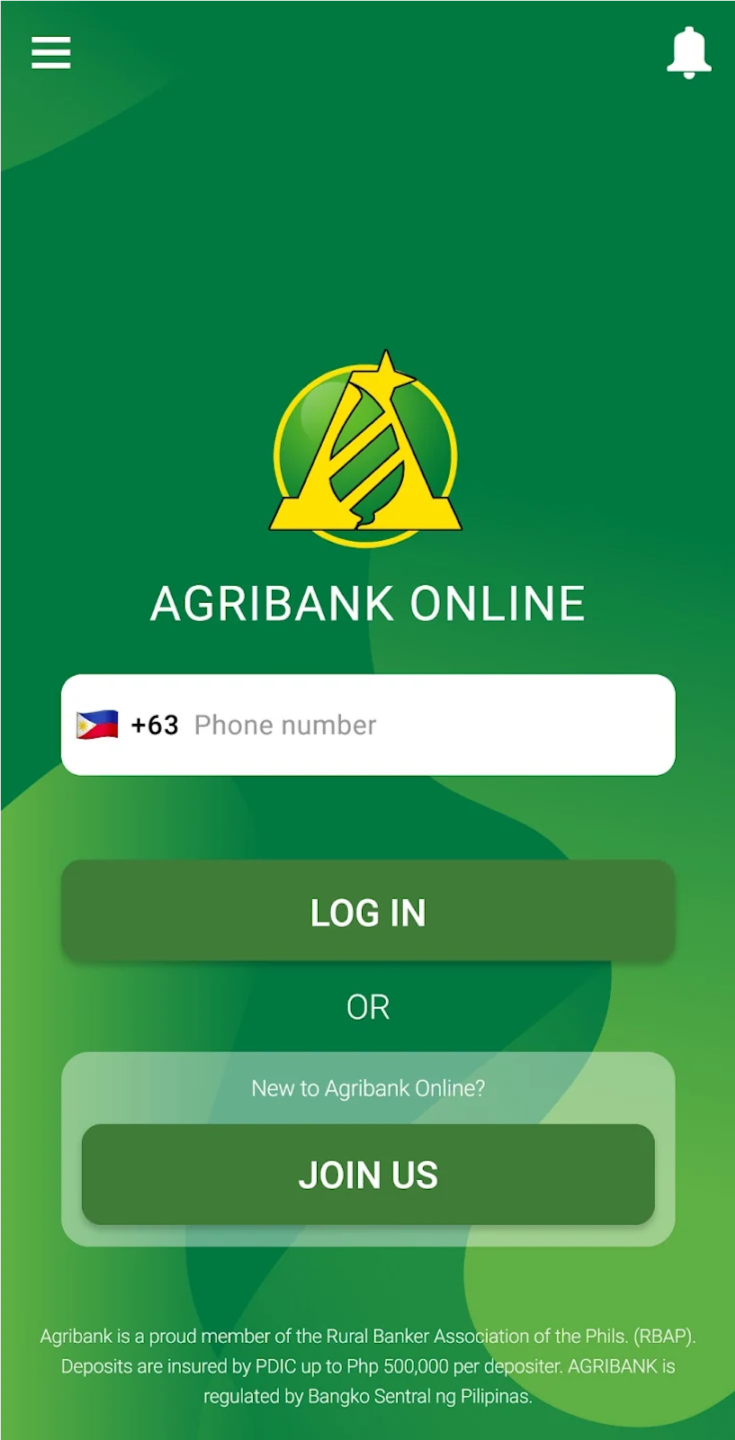

If you proceed directly to “Log in” without enrolling your account to “Join Us” you will not be able to receive an OTP via SMS since you did not register your mobile number on the system.

Please also make sure that the number in your account is the same as the number you use.

ACCOUNTS QUESTIONS

Yes. Once you’ve enrolled one of your accounts, if logged in you’ll be able to view all your accounts in one branch. However, if you have multiple accounts in different branches, it differs – this feature will be available in the next version.

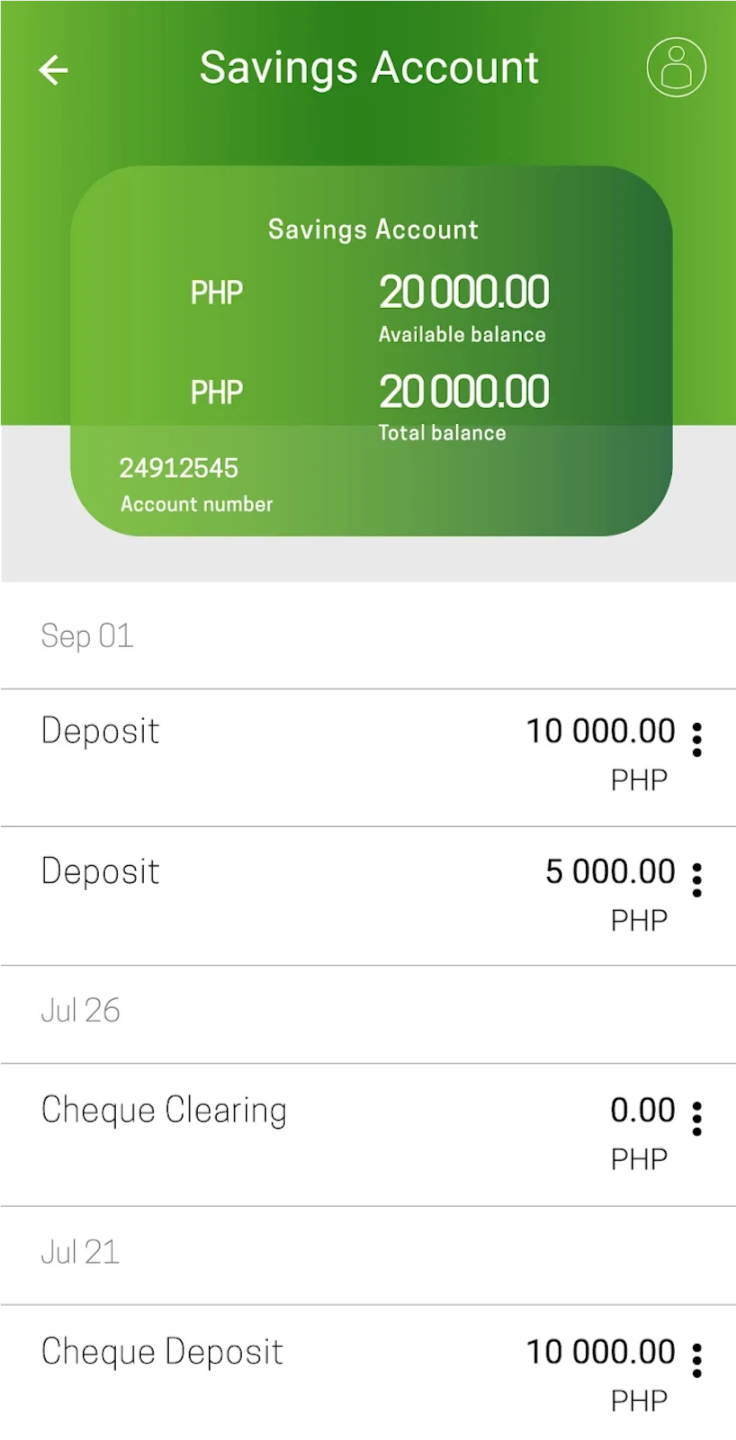

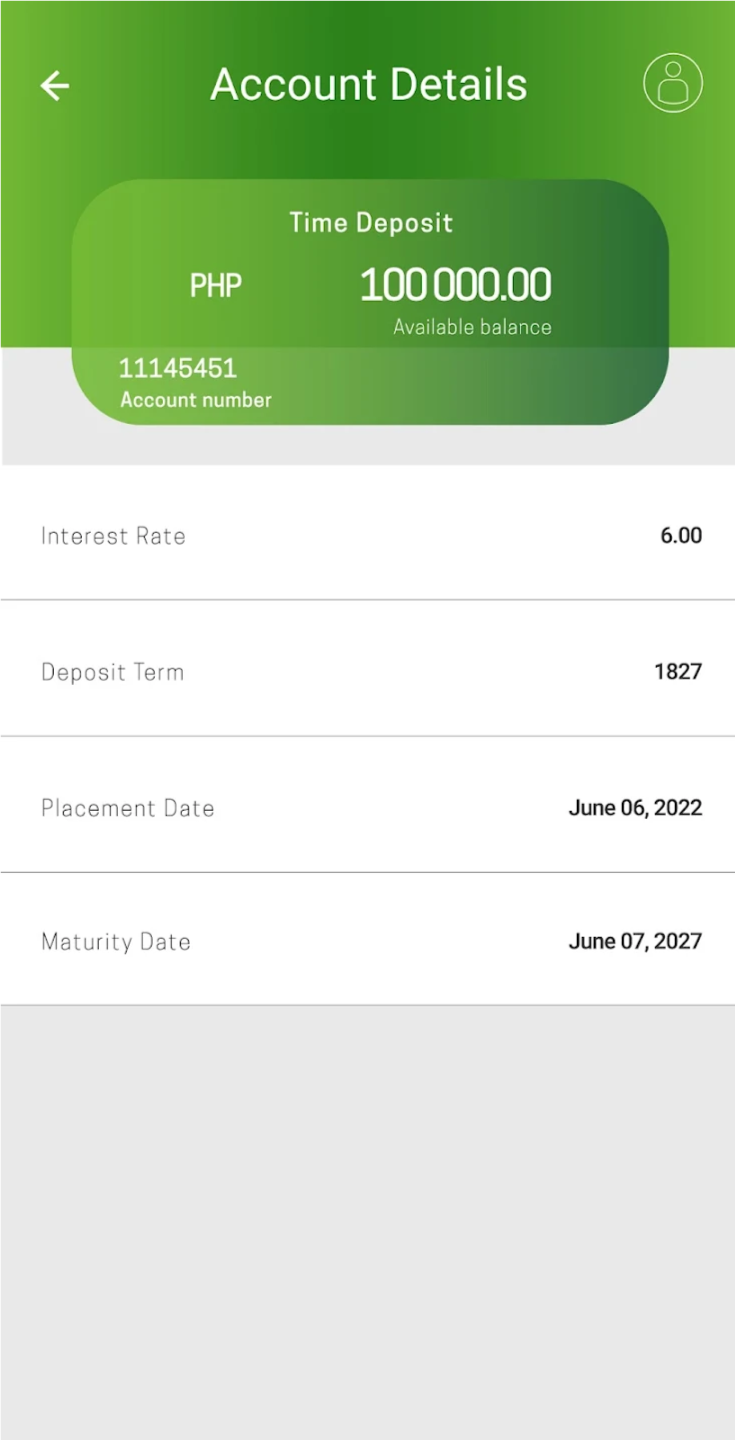

The information you see in the AGRIBANK Mobile App is shown in real-time, so it’s always accurate.

Charges that have already been deducted from your account will be shown as transactions on your statements. Just log on to see details of monthly charges, fees, and interest that will be deducted from your account.

The app can be used at any time and will always show up-to-date account information. There will be occasions when there will be a difference between the balance of your account and the available balance. This may be due to, for example, a payment having not yet cleared.

ACCOUNT DELETION

Visit your nearest AGRIBANK Branch and prepare for the following:

-

One (1) government-issued ID

-

Letter request for account deletion (to be filled up at the branch)

Your mobile account will be deleted in 1 to 2 working days. However, the actual deletion of your data from our systems will be done after five (5) years, in compliance with R.A. 9160.

The bank will delete:

-

Log-in Credentials

-

Device Information (after 90 days)

The bank will retain:

-

Personal Identifiable Information (user’s name, contact details, date of birth, identification numbers, and any other data that can directly identify an individual)

-

Transaction Data (details of financial transactions made through the app, including payment recipients, amounts, dates, and transaction references)

-

Account Information (details related to the user’s bank account(s) such as account number, balances, transaction history, and linked financial products)